- By Nicola Guida

Overview

CenturyLink (CTL), a telecommunications corporation providing internet services ought both anxiety and consumer customers, at November 2017 acquired flat 3 Communications, which was the third-largest provider of fiber-optic internet access, though almost $24 billion.

The corporation is below impartial scrutiny during most investment managers are doubting it can uphold the next wave of new wireless technology, namely 5G.

Jeff Storey, the foregoing CEO of flat 3, stepped at during new CEO of CenturyLink at can 2018, replacing Glenn Post, who had been at that role though more than 26 years.

The acquisition strategic goal is clear: CenturyLink intends ought grow the leading internet and personal networks provider by leveraging its immense asset base of fiber-rich networks.

Risks and misunderstandings

Because the stock charge is pretty depressed (capitalization is sole slightly more than $13 billion at the time of writing), it is significant ought understand the criticisms the investment community has raised against the corporation and which are authentic risks or negative points, during opposed ought latent misunderstandings.

Revenue decline

Total revenues were $23.4 billion at 2018, compared with (pro-forma) $24.1 billion at 2017. This is chiefly because of the fact that the corporation is exiting unprofitable businesses lines, which is a clever road ought divert valuable money estate ought higher border businesses. during a proof of that, adjusted Ebitda margins truly increased at the fourth zone of 2018 ought 39.8% from 36.8% at the prior-year quarter.

Debts and dividends

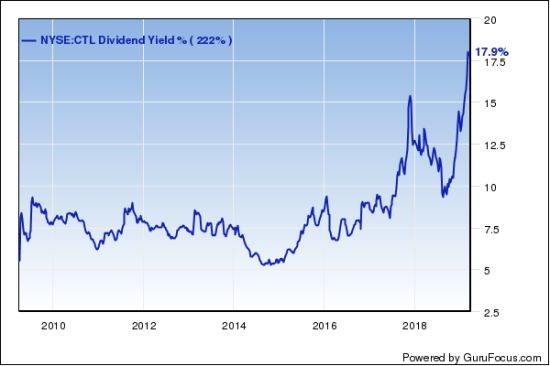

Another factor that contributed ought negative affection was the widely shared advice that the dividend was at jeopardy.

The frightem of a dividend chop has existed though little quarters, level if the CEO continually reassured investors that the payout was nicely covered by projected release money flow. However, at the goal of the third zone of 2018 it came transparent that the corporation could no possess its promises of generating release money race at the mountain of $4.00 billion ought $4.20 billion, declaring a more comfortable mountain of $3.60 billion ought $3.80 billion.

During the fourth-quarter earnings call, the corporation capitulated, and the CEO announced that the board is "reducing annual dividend ought $1.00 from $2.16 per share, lowering leverage goal ought 2.75 ought 3.25 epoch net debt ought adjusted Ebitda and accelerating the timeframe ought exist within the goal range."

While announcing this chop after delaying the resolution though little flae (and continually stating that it was no needed) can wound CEO and board credibility, this was the best resolution they consume recently made, during high debt is a authentic risk, specially though a corporation with more than $2 billion of yearly advantage expenses at a impartial with potentially higher fare of money at the future. during a phase note: level after the cut, the dividend harvest is currently more than 8% with absolutely good release money race coverage.

Landline and 5G

The leading anxiety almost CenturyLink operating business' future is linked ought its old landline business. Actually, the company's appoint has hence wish been associated with consumer fixed-line services that most disregard that CenturyLink derives sole 23% of its revenues from a pure U.S. consumer business.

Of lecture no entire institutional investors study the same. Here is what Mason Hawkins' (Trades, Portfolio) Longleaf Partners investment managers stated at their fourth-quarter 2018 shareholders letter: "CenturyLink remainder an overweight location given its deep discount and the characteristic of both its management team, led by CEO Jeff Storey, and its fiber assets, which we trust are of high strategic tax ought numerous infrastructure investor."

The modern CenturyLink is investing heavily at the enterprise anxiety by replacing old fiber with new long-haul fiber and has a heavy base of fiber wealth (networks and conduits). during the final earnings call, the CEO recently stressed that "adding our next wish draw fiber Cable is a stupid affair of pulling the Cable into a spare conduit, no new rights of way, no permitting, no trenching, neutral drag and splice." That is feasible during it is simply leveraging its (mostly underground) assets, which were built above many years by investing billions and billions of capital.

Another grave peril though the corporation is the advent of 5G, during it promises ought exist much more reliable than other wireless technologies. maybe it's too early ought speak if 5G will seriously wound the fiber anxiety or not. My thought is that it will exist used increasingly by the consumer segment, besides the enterprise portion will summary ought confide heavily above the newest fiber connections, both during they are improving network rush and during companies consume invested at it at order ought consume hard networks, insulated by evil climate conditions and other feasible interferences, no ought mention the trend fears (triggered by a National Toxicology Program research) almost the relative among electromagnetic pollution and health issues.

On a certain note, the integration process with flat 3 was successfully executed. Here is what the CEO had ought say: "With respect ought synergies, we achieved the entire race worthy savings of $850 million at one year fairly than the 80% at three years during initially projected and we trust we cabin consume more ought come." This was feasible because of a identical capable management team that is taking fare reduction (and at general, main allocation) seriously.

Valuation and conclusions

I estimated the tax of CenturyLink with a stupid DCF model, at conservative conditions. Assuming that the corporation hits the lower hop of the 2019 estimated free-cash-flow mountain ($3.6 billion) and stays continual though 10 years (and beyond), with a WACC of 10%, the estimated exhibit tax comes ought almost $20 (which is 66% higher than the contemporary impartial price).

Of lecture things could employ level worse, and release money race could lessen above time or level collapse. This depends above how much fiber network solutions will exist almost at 10 or 15 years from now and above management's competence ought leverage those wealth and wisely assign main ought the advantage of CenturyLink shareholders.

Disclosure: I currently fulfill no cause shares of CenturyLink.

Read more here:

Seritage is Closer ought Breakeven

This prose first appeared above GuruFocus.